Transfer Pricing in Family Offices: Navigating Generational Shifts

Over the next two decades, we are going to witness an unprecedented transfer of wealth, estimated at $90 trillion in the US alone[1], phenomenon denominated “great wealth transfer”[2].

This approaching transfer of wealth, including both ownership and decision-making power, from older generations to the succeeding ones, will require that family offices adjust their investment strategies to align with the mindset of the new generation. This adjustment may also imply potential restructuring of businesses to better suit the preferences and priorities of the emerging successors.

Thus, it is crucial to consider the perspectives and actions of Family Offices to understand the implications for transfer pricing. This article delves into the current landscape of European family offices, Luxembourg family offices, and their involvement in transfer pricing, addressing typical intercompany transactions, transfer pricing requirements, and the associated challenges.

European family offices

In accordance with a report from Campden Wealth, which is based on a survey to European single-family offices and private multi-family offices, it is reported that the collective wealth of participating European families is US $177 billion and family offices control, on average, US $0.9 billion[3] of assets under management (AUM). The two largest asset classes in European family office portfolios are equities and private markets (private equity, venture capital, and private debt) both averaging 28% of AUM.

Insights derived from the same report suggest that a significant percentage of European family offices are planning to increase their allocation to private markets and alternatives. Despite some considering divestment, a net increase is anticipated, with:

- 28% in private equity,

- 21% in venture capital,

- 21% in real estate,

- 15% in developed market bonds/equities,

- 15% in forestry and agricultural land,

- 9% in hedge funds,

- 6% in Cryptocurrency / digital assets, and

- 4% in Commodities.

Regarding geographic asset allocation, the data indicates a robust diversification strategy among European family offices, with approximately half of their assets allocated in Europe, followed by 29% in the United States and 7% in Asia. Nevertheless, anticipations reveal an expected net increase of 23% in the United States and 21% in the Asia Pacific region, signifying a strategic realignment in global asset allocation strategies.

Luxembourg family offices

In accordance with a report from UBS, which is also based on a survey but to Global family offices, the wealth of families is founded on a combination of operational and investment activities.

Concerning their operational businesses, it is estimated that a substantial portion (79%) of family offices[4] maintain close connections with them. Notably, common sectors for these operational businesses include real estate (38%)[4], industrials (21%)[4], financials (20%)[4], and consumer discretionary (19%)[4].

Furthermore:

- A significant portion (37%)[4] of family businesses transfer cash flows into family offices for ongoing investments.

- Nearly half (48%)[4] of family offices operate entirely independently from the family’s operational businesses.

- While in 8% of cases[4], the family office injects cash into the family’s operational businesses.

Regarding their investment businesses, wealthy families typically manage their investment activities through either a multi-family office or a single-family office.

Multi-family offices specialize in providing comprehensive wealth management services to multiple wealthy families, acting as independent service providers with no direct or indirect ties to the trusts, investment vehicles, and foundations associated with these families.

Current data from the “Commission de Surveillance du Secteur Financier” (CSSF) indicates the existence of 66 multi-family offices[5] based in Luxembourg. Moreover, several other entities own alternative licenses, facilitating wealth management services for individuals and families.

Single-family offices specialize in providing tailor-made wealth management services to one individual and his family. It is often owned by the individual and his family or trusts which own investment vehicles for performing multi type investments.

It is worth mentioning that gathering precise and reliable data on single-family offices is challenging due to a considerable number of entities being categorized as “Business and other management consultancy activities”, even though their primary purpose is to operate as family offices.

“Single-family offices do need to contemplate transfer pricing considerations, as they operate exclusively to serve to one individual and his family, who do control or own the office. In this scenario, transfer pricing considerations should be taken into account when determining compensation for the services provided by the single-family office to trusts, investment vehicles, foundations, or operational businesses associated with the family members.”

Family offices involvement in transfer pricing

The transfer pricing considerations may arise according to the level of relationship among wealthy families, family offices, foundations, trusts, investment vehicles and operational businesses.

Multi-family offices do not typically require the observation of transfer pricing considerations, as they operate to serve multiple wealthy families, who do not control or own the office. However, exceptions may arise if the multiple wealthy families have ownership stakes in the multi-family office and hold direct or indirect shares in the associated foundations, trusts, and investment vehicles.

Single-family offices do need to contemplate transfer pricing considerations, as they operate exclusively to serve to one individual and his family, who do control or own the office. In this scenario, transfer pricing considerations should be taken into account when determining compensation for the services provided by the single-family office to trusts, investment vehicles, foundations, or operational businesses associated with the family members.

Typical intercompany transactions within Family Offices

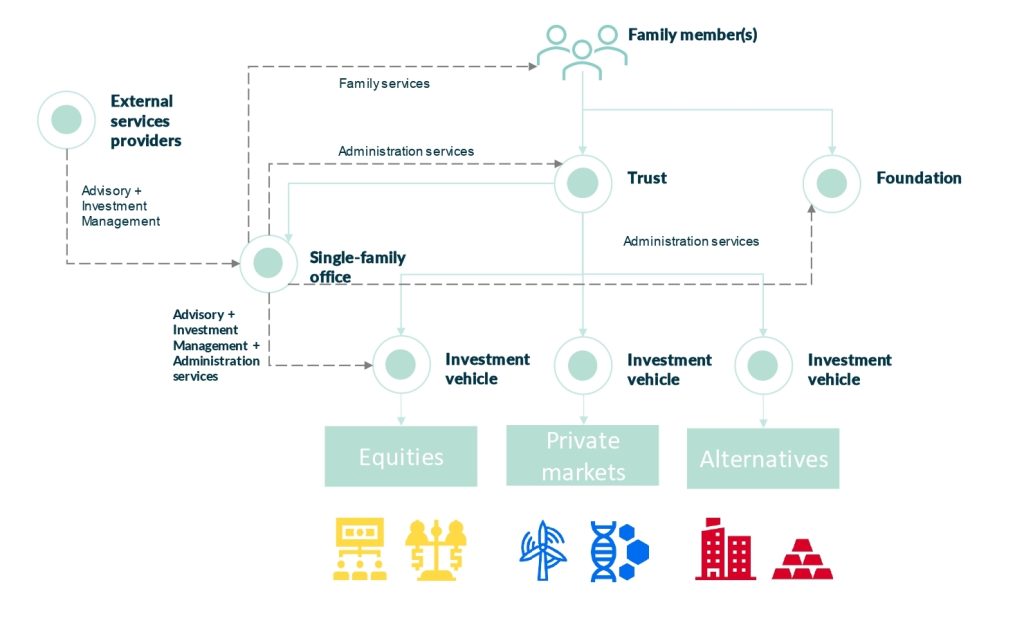

The extent of intercompany transactions within single-family offices depends on the degree of interaction between their operational and investment businesses. For wealthy families with investment businesses, their single-family offices typically offer a range of services including advisory[6], investment management[7], family[8] and administration[9] services to family members, trusts, investment vehicles, and foundations.

The figure below illustrates the typical setup of a single-family office, primarily designed to support the activities of the investment businesses of family members.

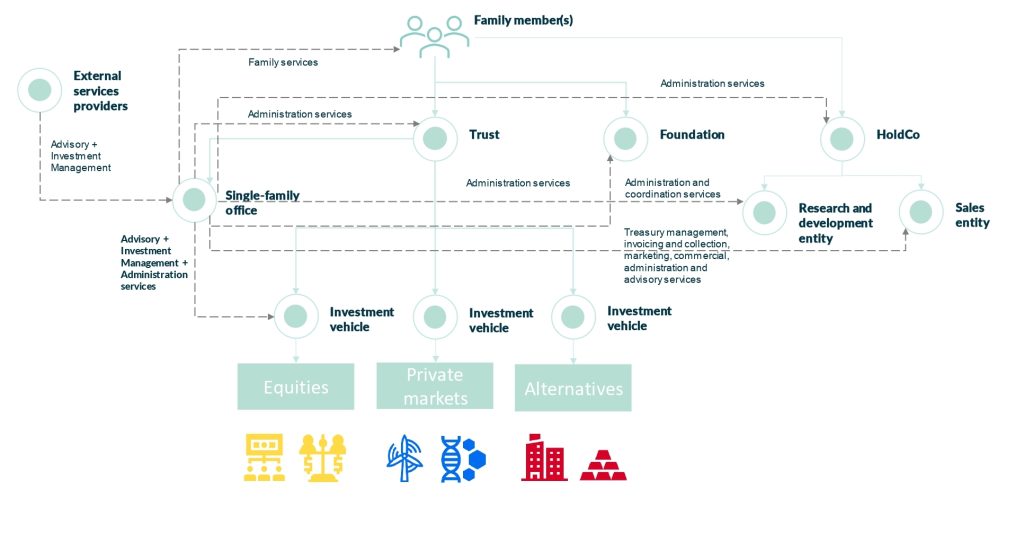

Conversely, in cases where wealthy families engage in both operational and investment businesses, single-family offices commonly provide additional support such as treasury management, invoicing and collection, marketing, commercial, coordination, as well as advisory and administration services tailored to the operational businesses of family members.

The figure below illustrates the typical setup of a single-family office, primarily designed to support the activities of the operational and investment businesses of family members.

Transfer Pricing requirements for Family Offices

In accordance with Luxembourg transfer pricing regulations[10], all transactions between a Luxembourg company and its group or associated companies must adhere to arm’s length market conditions, as no exceptions or thresholds are provided by law.

As a result, every family office engaging in intercompany transactions must ensure that these transactions comply with the arm’s length principle. Compliance requires the preparation of transfer pricing documentation, which must be readily available to the Luxembourg tax authorities upon request. This documentation should support the data included in the tax returns concerning transactions between associated entities.

In practice, local tax authorities typically set a deadline of 1 to 2 weeks for the submission of transfer pricing documentation, with the possibility of extensions in some cases. Failure to comply may result in general administrative fines[11] ranging from a minimum of 5% to a maximum of 50% of the avoided taxes.

“As a result, every family office engaging in intercompany transactions must ensure that these transactions comply with the arm’s length principle. Compliance requires the preparation of transfer pricing documentation, which must be readily available to the Luxembourg tax authorities upon request. This documentation should support the data included in the tax returns concerning transactions between associated entities.”

Transfer Pricing challenges for Family Offices

The transfer pricing challenges for single-family offices are influenced by the complexity of intercompany transactions, the involvement of family members, activities exercise by associated entities, and compliance requirements across jurisdictions.

Here are some potential transfer pricing challenges:

- Ensuring that the compensation charged for the various services provided to different entities within the family’s ecosystem is in line with the arm’s length principle.

- Managing transfer pricing compliance requirements across multiple jurisdictions.

- Monitoring the validity of the transfer pricing policy and documentation.

- Managing transfer pricing audit resolutions with local or foreign tax authorities.

- Implementing intercompany services agreements in accordance with the arm’s length principle.

- Adjusting transfer pricing policy, documentation, and agreements in accordance with changes in the nature or scope of the services.

- Allocating expenses among the operational and investment businesses.

- Properly aligning the actual conduct of the parties in relevant documents.

Conclusions

The evolving landscape of family office business strategies demands modifications to existing intercompany services or the introduction of new ones. Therefore, it is imperative to observe the complexities associated with managing intercompany transactions and investments. As family wealth extends across generations, effective risk management and compliance with transfer pricing regulations emerge as top priorities.

This priority is highlighted by a significant percentage of family offices planning to increase their allocation to private markets and alternatives. This strategic shift emphasizes the importance of navigating transfer pricing challenges with diligence and anticipation, ensuring that intercompany transactions align with regulatory requirements while optimizing investment opportunities for future generations.

[1] Source: The article “Millennials stand to become the richest generation in history, after $90 trillion wealth transfer” published by CNN on March 1, 2024.

[2] Source: The article “Great Wealth Transfer: How The $90 Trillion Windfall for Millennials Could Change The Job Market And Economy” published by “Forbes” on March 1, 2024.

[3] Source: The European Family Office Report 2023. The report was prepared by Campden Wealth in partnership with HSBC Global Private Banking and published on December 4, 2023. It is based on a statistical analysis of 102 survey responses from European single-family offices and private (not commercial) multi-family offices.

[4] Source: The Global Family Office Report 2023. The report was prepared by UBS AG and published on May 31, 2023. It is based on a statistical analysis of 230 survey responses from global family offices.

[5] Source: The CSSF Statistics. 43 Authorised Family Office out of 66 are not performing actively the activity Family Office.

[6] Advisory services include estate/financial/tax planning, insurance, legal and succession.

[7] Investment management services include accounting, asset allocation, due diligence, real estate, reporting, risk management, administration, custody & reporting, and performance.

[8] Family services include concierge, next-gen education, security, and travel.

[9]Administration services include Human resources, information technology and premises.

[10] Luxembourg transfer pricing rules are disclosed in Article 56 and 56bis of the Luxembourg Income Tax Law (LITL), §171 of the Luxembourg Tax Code, and Circular L.I.R. No. 56/1-56-bis/1 (the “Transfer Pricing Circular”)

[11] The general administrative fines are disclosed in section I of the circular LG – A n ° 67.

Authors

Search posts by topic

Advisory (7)

Alternative Investment (24)

Alternative investments (3)

AML (1)

Art (1)

Asset Management (27)

Banking (16)

Capital Markets (1)

Compliance (1)

Crypto-assets (3)

Digital Assets (3)

Digital banking (6)

Diversity (7)

EU (6)

Family Businesses (4)

Family Offices (2)

Fintech (10)

Fund distribution (22)

Governance (8)

HR (9)

ICT (1)

Independent Director (5)

Insurance (2)

Internationalization (1)

LATAM (9)

Legal (10)

Private Equity (4)

Regulation (1)

Reinsurance (2)

RRHH (9)

Sustainable Finance (23)

Tax (15)

Technology (6)

Transfer Pricing (2)

Trends (18)

Unit-linked life insurance (6)

Wealth Management (12)