Homeworking: Are you ready for the end of the social and fiscal tolerances related to the health crisis?

Topics: HR

Not very widespread in Luxembourg these last years, the practice of telework has intensified massively in 2020 in the Covid context. In this field, legislation could soon evolve to better adapt to the evolution of current work modes. On a talent acquisition and retention point of view, it is a question of capability for Luxembourgish employers to attract talents, and to guarantee worklife balance for employees . This is more than ever a topical issue, since the Covid-19 legal and fiscal exceptions will end by June, 30th.

In Luxembourg, almost all employees have experienced telework at least once. If for the majority of us, this practice consists in working at home (home working), there are other less known forms. “For example, there is telecenter working, which means working outside the company’s normal premises, in a space rented by the company or by another organization”, explains Joël de Marneffe, Head of Tax & Legal and Legal Expert at SD Worx. In addition, the employee can go to a client’s premises for an appointment and continue to work there, rather than returning home or to the company (mobile teleworking).

A practice based on dialogue

Since March 2020, telework has exploded. For employers who want to make this practice permanent in their company, it is now a question of deciding whether telework at home is implemented on a regular or occasional basis.

Telework should remain a voluntary practice, i.e. by mutual agreement between the employer and the employee. “I think the best thing is to inform the employees well and to be well informed yourself before implementing such a policy”, explains Joël de Marneffe, Head of tax & legal and legal expert, SD Worx.

In this context, managers have the opportunity to set up a framework within the company that guarantees trust towards employees and maintains links with them, while ensuring that functions that are not predisposed to telework are adapted as much as possible

Adopt more flexible and favorable regulations

In this context, the old and relatively strict legal framework should soon evolve to apply to the current situation and allow people to work more from home. Another constraint for managers concerns cross-border employees. Several obstacles to teleworking exist for them: social security affiliation but also tax tolerance days. “In order to make telework sustainable, you have to ask yourself what kind of regulation to implement, if it is not necessary to impose a ceiling on frontier workers (social ceiling of 25%) and make sure to inform them that tax tolerances exist in terms of taxation but that it is possible and sometimes interesting to go beyond them”.

The Luxembourg and cross-border legal framework

Social security:

Luxembourg and its three neighbouring countries, namely Germany, France and Belgium, have agreed to maintain the exceptional provision of not taking into account the days of teleworking linked to the COVID-19 crisis for the determination of the social security legislation applicable to frontier workers until 30 June 2022.

In concrete terms, this means that a frontier worker who carries out his work from home will continue to be affiliated to the Luxembourg social security system until that date, even if the 25% threshold provided for in the European legislation for the workers concerned is exceeded.

But as from 1 July 2022, and at the time of writing, this tolerance should no longer exist and teleworking days on the State of residence will be included in determining the 25% threshold.

However, it seems that things are moving very fast on this issue and the Administrative Commission for the Coordination of Social Security Systems, composed of a government representative from each Member State, met on 17 June to propose a transitional period from 1 July to 31 December 2022 during which :

there is no need to apply for A1 for cross-border telework and

telework days are not taken into account in the calculation of the 25%.

Nevertheless, this information was not officially confirmed by the social security institutions of the employees’ countries of residence at the day of writing.

Taxation:

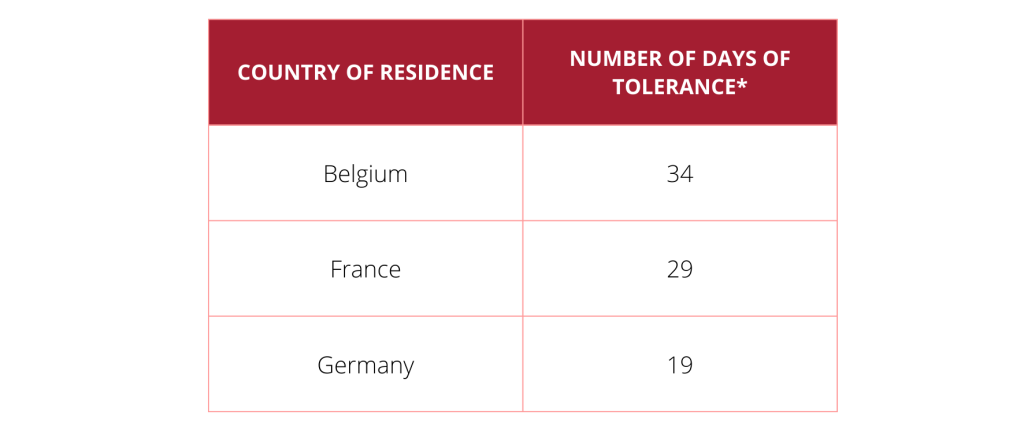

The days worked at home only because of the measures taken to combat the Covid-19 pandemic are to be excluded from the calculation of the tolerance days provided for in the tax agreements until 30 June 2022.

The SD Worx legal experts assist you in structuring and validating the legal compliance of your homeworking policy.

- Online catalog training:

- “Télétravail post-Covid: Conformité légale et impact social (French). In September – Complete information on our website : www.sdworx.com/fr-lu

- The organization of personalized training sessions for your employees:

- We organize 2 hours sessions in French and/or English to inform your employees about the legal, social and fiscal impacts of teleworking, after the end of the health measures. All in accordance with the HR policy that you have developed.

- Specific support to structure and validate your approach:

- Workshops to support your HR team

- Drafting of a personalized memo containing the rules applicable to structural teleworking and suggestions for compliance in your company

Have you reviewed your internal policies?

Have you updated your employees’ employment contracts accordingly?

Can you estimate the impact of exceeding the social and fiscal tolerances for cross-border commuters?

Discover the consulting solutions of SD Worx in our website : www.sdworx.com/lu-fr

Search posts by topic

Advisory (6)

Alternative Investment (14)

AML (1)

Art (1)

Asset Management (12)

Banking (11)

Compliance (1)

Crypto-assets (3)

Digital banking (3)

Diversity (1)

EU (5)

Family Businesses (3)

Family Offices (2)

Fintech (9)

Fund distribution (13)

Governance (3)

HR (4)

ICT (1)

Insurance (1)

Internationalization (1)

LATAM (2)

Legal (2)

Private Equity (4)

Reinsurance (1)

Sustainable Finance (18)

Tax (12)

Technology (5)

Transfer Pricing (1)

Trends (14)

Unit-linked life insurance (5)

Wealth Management (10)