The European Regulation relating to ESG disclosure – the SFDR – came into force on 10 March 2021 in all of the European Member States. This forms part of the EU’s package of measures relating to Environmental, Social and Governance (ESG) issues. the European Union financial sector had to adequate their internal policies regarding the sustainability-related disclosures in order to comply with the SFDR Regulation (as defined below). Therefore, in this article we are going to explain the origin and key points of this new ESG policies that are applying in the European Union, and in particular their impact in the Grand Duchy of Luxembourg.

Big picture

Deriving from the new global sustainable development framework adopted by the United Nations General Assembly, the European Commission approved the 2030 Agenda for Sustainable Development having at its core the Sustainable Development Goals (“SDGs”).

In the context of the European Union’s plan to develop the SDGs, on 27 November 2019 the European Parliament and the Council approved the SFDR Regulation, as well as the regulations generally known as Benchmark Regulation and Taxonomy Regulation.

The SFDR has been adopted with the purpose of creating a more transparent and harmonised framework of requirements for the Financial Market Participants and Financial Products (as defined below and in the SFDR) regarding the disclosure and publication of sustainability-related information.

Key points

The main addressees of the disclosure and transparency requirements set in the SFDR are the following, broadly present in the Luxembourg financial market, defined as the “Financial Market Participants”:

- investment firms and credit institutions which provide portfolio management;

- alternative investment fund managers (AIFMs); and

- management companies of UCITS management companies.

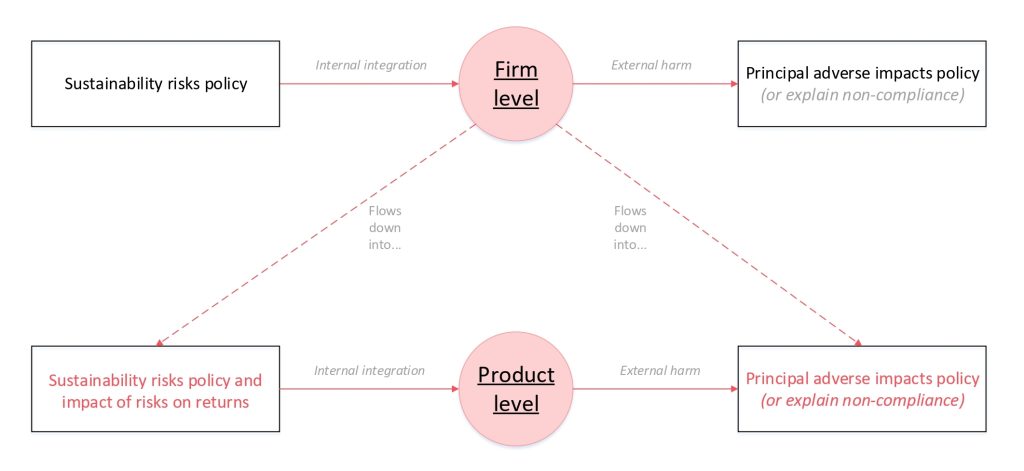

These Financial Market Participants need to apply the relevant requirements founded on publication and disclosure in three different levels:

- Firm Level: publication on their websites of their policies on the integration of sustainability risks in their investment decision making process and information about adverse sustainability impacts for their entity. This meant that the institutions had to update their existing investment policies or create new ones with a focus on ESG requirements. As for the adverse sustainability impacts, we talk about “comply or explain”. The market was given a choice to either implement a due diligence policy with respect to the principal adverse impacts of its investment decisions on sustainability factors or explain the reasons why it does not consider such adverse impact.

- Product Level: the disclosure obligation at product level applies, whether or not products with an ESG focus are offered. Here again a business decision needs to be made for each financial product that is made available, to either: assess the likely impacts of sustainability risks on the returns of each financial product; or explain why it does not consider sustainability risks to be relevant to a particular financial product. investors are required to be provided with pre-contractual disclosures descriptions about the products being made available to them.

- Environmental or Social Products Level: where financial products specifically promote ESG characteristics, the SFDR provides that Financial Market Participants are required to publish information about how those characteristics are met and if an index has been designated as a reference benchmark, information on whether and how index is consistent with those characteristics.

In addition to the specific disclosure obligations, it is also advisable for market participants to review their marketing documentation generally, to ensure that these do not contradict the mandatory disclosures. At first glance it may seem that the aspects of the SFDR only apply to asset managers of ESG products but a big part of the requirements applies much more broadly, and also captures for example banks offering portfolio management.

UCITS prospectus update: fast track procedure in Luxembourg

As the SFDR is directly applicable in all Member States of the European Union, there are only few national specificities worth raising from a Luxembourg perspective. One relates to UCITS and AIFs’ prospectuses and the so-called “fast-track” procedure put in place by the CSSF (the Luxembourg Financial Regulator). Because these products need to be compliant with the SFDR requirements before the 10 March 2021, the CSSF made it possible to submit updated prospectus/issuing documents where the changes resulted directly the SFDR requirements. This allowed the market to ensure compliance with the relevant requirements before the deadline, without having to go through the normal procedure for prospectus approval.

What do we see:

There is a lot of divergence on approach across the market and some firms prefer the “explain” approach and opt for minimum compliance. At the other end of the spectrum you find the “SFDR-friendly” firms who have gone all the way and even further to comply with the requirements under SFDR. Because the regulation provides a certain degree of flexibility, market participants can decide how they want to profile themselves. What is certain is that this is only just the beginning and the future of finance will be founded on sustainability.