The CaixaBank AM Group evolves its liquid alternatives management model by delegating mandates to international third-party asset management companies for its discretionary management service for Master Portfolios

Topics: Asset Management, Fund distribution

For the implementation of these strategies, the CaixaBank Alternative Master Fund, FI will invest in a Luxembourg fund (CaixaBank Global Alternative Strategies) using our Luxembourg asset management company, CaixaBank Asset Management Luxembourg (100% owned by CaixaBank Asset Management). With this project, the Luxembourg asset management company, which celebrates its 30th anniversary in Luxembourg this year, will multiply its assets under management.

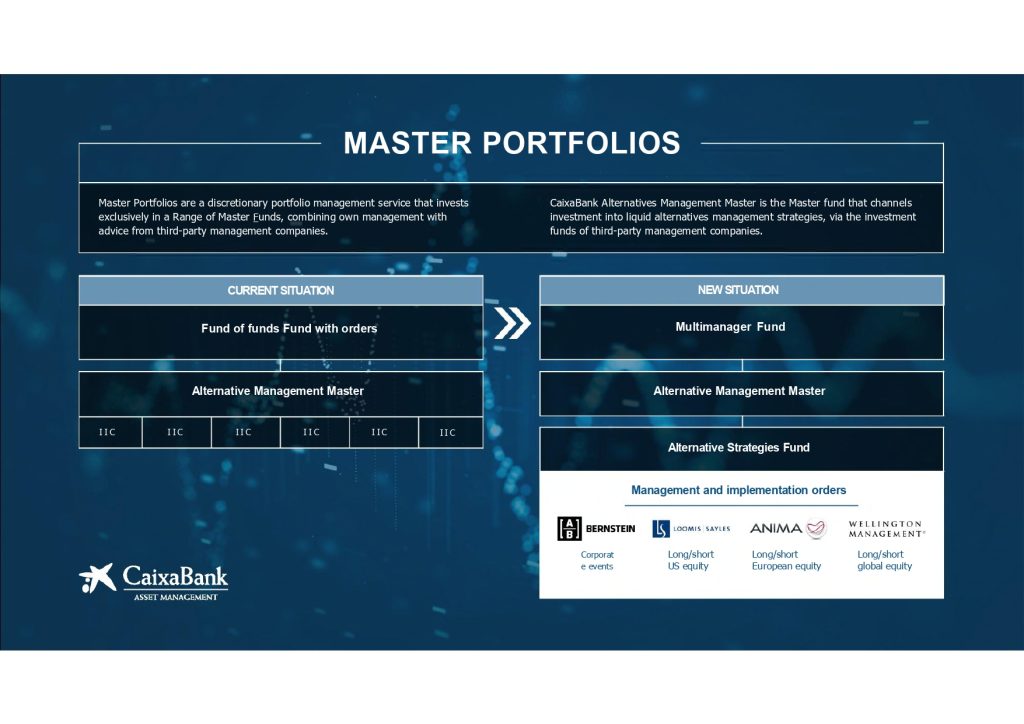

In 2019 we launched the Master Portfolios service in Spain, with a current volume of more than €33,000 million, which invest in exclusive CaixaBank Master funds with direct investment in the different financial markets and which include the advice of 5 specialist international fund managers. At the launch of Master portfolios, investment in liquid alternatives remained in funds of funds.

After the successful experience of the Master portfolios since their launch, we have decided to go one step further in the alternative management model. We are transforming the funds of funds into funds with direct investment through the delegation of management to different international fund management companies. With this change, we are pursuing a threefold objective: transparency, flexibility and efficiency.

- Transparency: direct access to the securities and strategies that constitute the portfolios

- Flexibility: mandates tailored to management needs.

- Efficiency: access to the best international asset managers avoiding a less agile and more cost-efficient fund structure.

- The new model is part of the Master Portfolio management service in the liquid alternative asset class.

- The fund delegates mandates to different managers with specific strategies, providing an adequate diversification of risks. This delegated management is done through a platform, which is very innovative and makes it possible to be very efficient in making changes of mandates and asset managers in an agile manner.

- The selected asset managers are as follows:

- Wellington Management (global long/short equity strategy)

Wellington Management serves more than 2,500 clients in over 60 countries. The firm manages over $1.1 trillion, making it one of the world’s largest and most experienced independent managers of alternative management strategies. Our tailored mandate is supported by the firm’s top equity managers.

- Anima (European long/short equity)

Anima is one of the leading independent asset managers in Italy, with €191.5 billion of assets under management. The selected mandate has one of the best track records of its strategy, standing out for its flexible management approach that adapts to every macroeconomic market scenario.

- Loomis Sayles (long/short U.S. equities)

Loomis, Sayles & Company, a subsidiary of Natixis Investment Managers, manages $335 billion in assets globally. This mandate is an alternative long/short equity investment strategy of growth companies, managed by a team with more than 12 years of experience. This long-term investment focus on quality, growth-style U.S. companies perfectly complements the fund’s portfolio.

- Alliance Bernstein (corporate events)

Alliance Bernstein L.P., holding company of AllianceBernstein Limited, is a leading investment management firm with $736 billion in client assets under management. This tailored strategy is based on a robust and consistent investment process, with a market neutral approach.

- All management mandates are compliant with European UCITS regulations with daily liquidity.

- The objective of this fund is to further increase the efficiency of the Master portfolios to the client, with greater transparency, more flexibility and efficiency.

- The fund will not vary the risk levels or alter the type of strategy in which it invests today and will benefit from the new structure.

- This new structure will allow CaixaBank AM to launch new similar initiatives in the future.

“In 2019 we launched the Master Portfolios service in Spain, with a current volume of more than €33,000 million, which invest in exclusive CaixaBank Master funds with direct investment in the different financial markets and which include the advice of 5 specialist international fund managers.”

Search posts by topic

Advisory (7)

Alternative Investment (24)

Alternative investments (3)

AML (1)

Art (1)

Asset Management (27)

Banking (16)

Capital Markets (1)

Compliance (1)

Crypto-assets (3)

Digital Assets (3)

Digital banking (6)

Diversity (7)

EU (6)

Family Businesses (4)

Family Offices (2)

Fintech (10)

Fund distribution (22)

Governance (8)

HR (9)

ICT (1)

Independent Director (5)

Insurance (2)

Internationalization (1)

LATAM (9)

Legal (10)

Private Equity (4)

Regulation (1)

Reinsurance (2)

RRHH (9)

Sustainable Finance (23)

Tax (15)

Technology (6)

Transfer Pricing (2)

Trends (18)

Unit-linked life insurance (6)

Wealth Management (12)