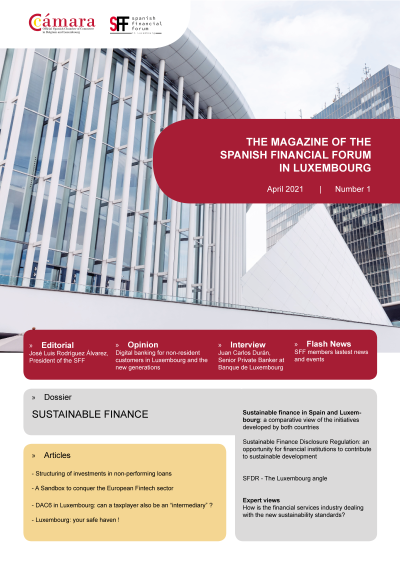

SFF Magazine April 2021

Read and download the

PDF version

The April 2021 issue of SFF Magazine is already out ! Click on the following link to read and/or download the PDF version.

Subscribe to the SFF Magazine

The first publication connecting professionals of the financial sector from Spain and Luxembourg

SFF Magazine April 2021

Read and share the

Digital version

Dossier Sustainable Finance

DOSSIER Sustainable Finance

Through the Action Plan on sustainable finance adopted in 2018, the European Commission set out the roadmap to boost the role of finance in building a European economy in order to achieve the goals of the Paris Agreement and the United Nations 2030 Agenda for…

Spanish banking sector leads the commitment to mitigate the adverse effects of climate change

“Since the European Commission adopted the first Action Plan on sustainable finance in 2018, rapid progress has been made in this field and the European banks have committed to becoming part of the initiative to mitigate the effects of climate change. In parallel to this…

Sustainable investment in Spain continues recording positive growth and maturity indicators

“Sustainable and Responsible Investment (SRI) in Spain has not only experienced a significant increase in recent years - according to our survey covering 65% of the total market, in 2018 ESG funds under management reached EUR 210,644 million, increasing to €285,454 million in 2019 (+36%)…

Sustainable Finance Disclosure Regulation: an opportunity for financial institutions to contribute to sustainable development

The Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector (SFDR) was adopted on 10 March. It has implied a substantial change in the sustainable investment framework, and has been the subject of much financial sector discussion over last year. The Sustainable Finance…

SFRD – The Luxembourg angle

The European Regulation relating to ESG disclosure – the SFDR – came into force on 10 March 2021 in all of the European Member States. This forms part of the EU’s package of measures relating to Environmental, Social and Governance (ESG) issues. the European Union…

How is the financial services industry dealing with the new sustainability standards?

“From an investor and a regulatory perspective, the financial product ‘manufacturers’ and ‘distributors’ are confronted with a suite of rapidly changing standards and expectations. The EU has elevated sustainability to be a key goal in their political agenda.

Articles

Structuring of investments in non-performing loans

Investment in non-performing loans and other non-performing receivables (collectively the NPLs) in Spain and other countries has become increasingly popular among investment managers in the past few years. This trend is expected to grow in the coming years, notably due to the adverse economic impact…

A Sandbox to conquer the European Fintech sector

In the midst of this pandemic, 2020 brought great news for the Spanish financial sector with the final adoption of the financial Sandbox, an initiative taken within the Digital Transformation Law for the Financial Sector. The Spanish Sandbox is configured as a controlled and non-deregulated…

DAC6 in Luxembourg — Can a taxpayer also be an “intermediary” ?

The international tax landscape has substantially changed over the last decade, and the fifth amendment to the 2011/16/EU Directive on Administrative Cooperation (DAC6) has prompted yet another shift in reporting obligations.DAC6 aims to collect information on reportable cross-border arrangements (RCBAs) in order for Member States…